hcad property search by address

Include your property address account number the property. Web Please keep in mind if filed through the Tax Office portal you can print copies of those documents and mail them to the Harris County Appraisal District HCAD.

However after the delinquency date the penalty and interest will accrue.

. All H-2A petitions received after the termination of this temporary final rule will be subject to the permanent provisions of. Harris County Appraisal District has no authority to receive tax payments from any jurisdiction. Pro members in Henderson County TX can access Advanced Search criteria and the Interactive GIS Map. Address PO Box 1525 Houston Texas 77251 Phone 713-755-6411 Fax.

Web You owned and occupied the property on January 1st of tax year you want to apply the homestead exemption. June 16 2021 is the final date that USCIS will accept H-2A petitions requesting flexibilities under the below temporary final ruleThe changes made by this temporary final rule will automatically terminate on June 16. It does not represent an on-the-ground survey and only represents the approximate location of property boundaries. 109 Gladstell Street Conroe TX 77301 936 756-3354 Hours.

The property owners name. However the property location can be determined by researching the account details available from the Harris County Appraisal District at. Business Personal. Web We would like to show you a description here but the site wont allow us.

The Hays County Appraisal District also provides a public property search with an advanced option for a variety of search queries. Low Income Housing Capitalization Rate. Web The HCAD Parcel Viewer provides the general public and other interested parties assessment. Web To find an address and the property profile.

Have a questions for us. Web The Tax Office accepts full and partial payments of property taxes online. Customer Service Survey. The Harris County Tax Assessor-Collectors Office Property Tax Division maintains approximately 15 million tax accounts and collects property taxes for 70 taxing entities including Harris County.

Web Search tax records in Harris and find Appraisal District information. The Harris County Appraisal District. Web The appraisal district is responsible for appraising property in the district for ad valorem tax purposes of each taxing unit that imposes ad valorem taxes on property in the district. Tax Records Search.

Web The platform has documents indexed since Aug 24 1848. Find Harris County residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions market valuations. Click on the blue I want to button to start an address search. To locate a parcel simply click on the map or enter an address or parcel number in the search box and select a parcel from the list.

Search property by name address or property ID. 1103 Houston St Levelland TX 79336-3521. What if a property has a 0 address. This usually comes in the form of a utility bill.

Physical Address 215 N 5th Street Room 223 A B Waco TX 76701. Monday - Friday 800 AM - 500 PM. All Public Records. PO Box 920975 Houston TX 77292 Direction.

Box 1090 Levelland TX 79336-1090. Web Specific question about exemptions values or name and address changes should be directed to HCAD at. Military Tax Deferral In 2003 the Texas Legislature passed a bill that provides qualified active duty military personnel serving during a war or national emergency outside the State of Texas a. Web Property taxes also are known as ad valorem taxes because the taxes are levied on the value of the property.

The Henderson County Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. List of all the forms used at this agency. 100 E 6th St. Property addresses are taken from the Harris County Appraisal District records and in some cases no address has been assigned to a vacant property.

Web What if a property has a 0 address. Office Info. Web The 2021 property taxes are due January 31 2022. Web Property Data Search - Henderson County Appraisal District HCAD Search Henderson County TX property records by Owner Name Account Number or Street Address.

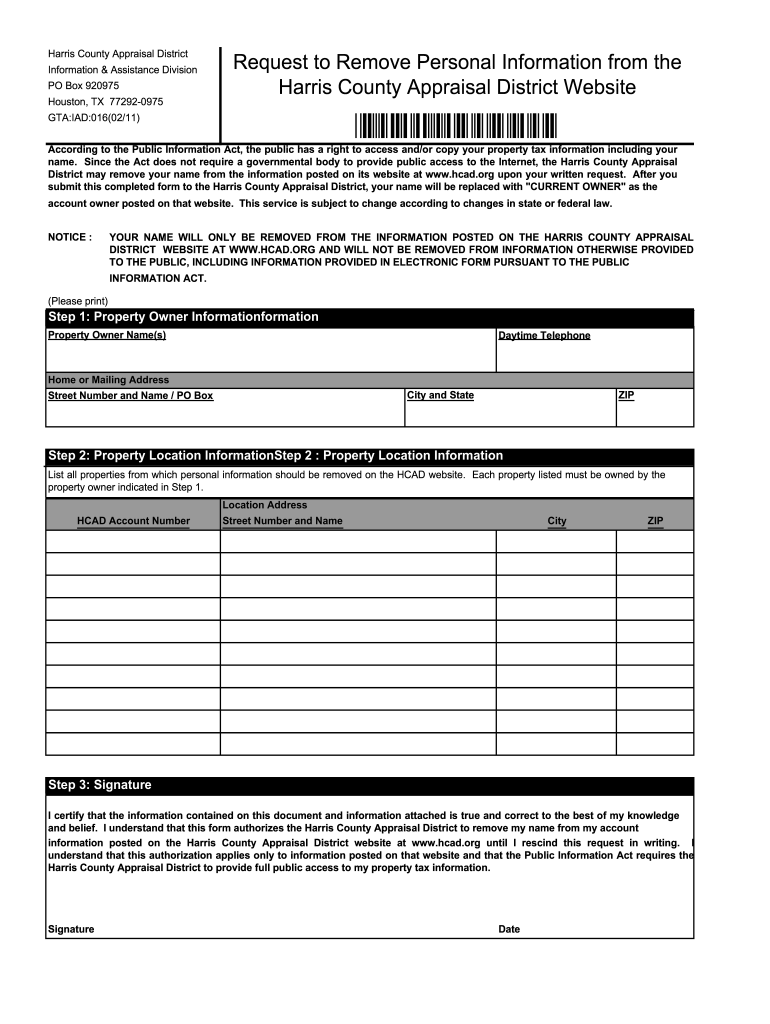

Free Harris County Assessor Office Property Records Search. HCAD mailing address is. Harris County Appraisal District Dealer Inventory Section PO Box 922015 Houston TX 77292-2015. Property Not Previously Exempt.

At HCAD offices located at 13013 Northwest Freeway. Click to to begin the online protest process. On the pull-down select Find My Jurisdiction and click on it. All tax payments must be mailed or delivered to the.

All information contained herein is distributed without warranty of any kind implied expressed or statutory. Hutchinson County Appraisal District. Property addresses are taken from the Harris County Appraisal District records and in some cases no address has been assigned to a vacant property. 920 Illinois Borger TX.

Find Harris property records property tax rates statistics and much more. The address or legal description of the property that is the subject of the protest. Web We would like to show you a description here but the site wont allow us. Occupying means you can prove you were living in the property.

By telephone at 713-957-7800. A notice of protest must include. Phone 713 957-7800. Users may search the online platform by name grantor grantee recording date range instrument number book and page numbers and document types.

It will show you a list of address matches. Web online using our M arriage Records Search. Web Property Tax Notice of Protest forms are available. Web Property Records Search.

Box 1727 Waco TX 76703. You are claiming this property as your primary residence. Tax payments cannot be accepted at HCAD. However the property location can be determined by researching the account details available from the Harris County Appraisal District at.

Harris County Appraisal. Web PROPERTY SEARCH. At any Harris County Tax Office. On the Address Search panel enter the address in the Start typing an address box.

Web Address 1001 Preston Street Houston Texas 77002 Phone 713-274-8002 Fax 713-368-2509. Web Real Property Search. Owning means the deed is in your name. 2022 Low Income Housing.

|

| Hcad Protest Form Fill Out And Sign Printable Pdf Template Signnow |

|

| Hcad And Alternatives To Finding Harris County Property Owners |

|

| How Do You Find Out If You Have A Homestead Exemption Discover Spring Texas |

|

| Hcad Electronic Filing And Notice System |

| Henderson Cad Official Site |

Posting Komentar untuk "hcad property search by address"